Banks that prioritize customer-first approach and satisfaction have a significant advantage over their competitors. They understand that their success depends on the happiness and loyalty of their customers. This blog post will explore why adopting a customer-centric approach is essential for banks and how it can drive better revenue.

Why is customer experience important in banking?

The financial industry has become increasingly competitive, with customers having more options. With the rise of mobile banking and digital transactions, customers have become more tech-savvy and expect seamless and personalized banking experiences. In this environment, customer experience has become a key differentiator for banks.

Customers want banks to understand their needs and provide personalized solutions that meet their specific requirements. They also expect quick and efficient service, whether they are banking online or in person. By prioritizing customer experience, banks can build strong relationships with their customers, which can translate into better revenue and profitability.

What are the benefits of a customer-centric approach in banking?

There are many benefits of adopting a customer-centric approach in banking. Some of the most significant benefits include

- Increased customer satisfaction: By prioritizing customer experience, banks can ensure customers are happy and satisfied with their services. This can lead to increased loyalty and retention, as customers are more likely to stay with a bank that meets their needs.

- Improved revenue: A customer-centric approach can lead to increased revenue, as customers are more likely to use additional services and products when they are happy with their overall banking experience. This can translate into higher profitability for the bank.

- Competitive advantage: By providing personalized banking solutions, banks can differentiate themselves from their competitors and attract more customers. This can help banks to stand out in a crowded marketplace and win new business.

Explore the Power of Digital Banking

Start your Digital Banking journey that is secure, scalable, connected, cloud-ready & flexible.

How can banks adopt a customer-first approach?

Banks can adopt a customer-centric approach in several ways. Some of the most effective strategies include

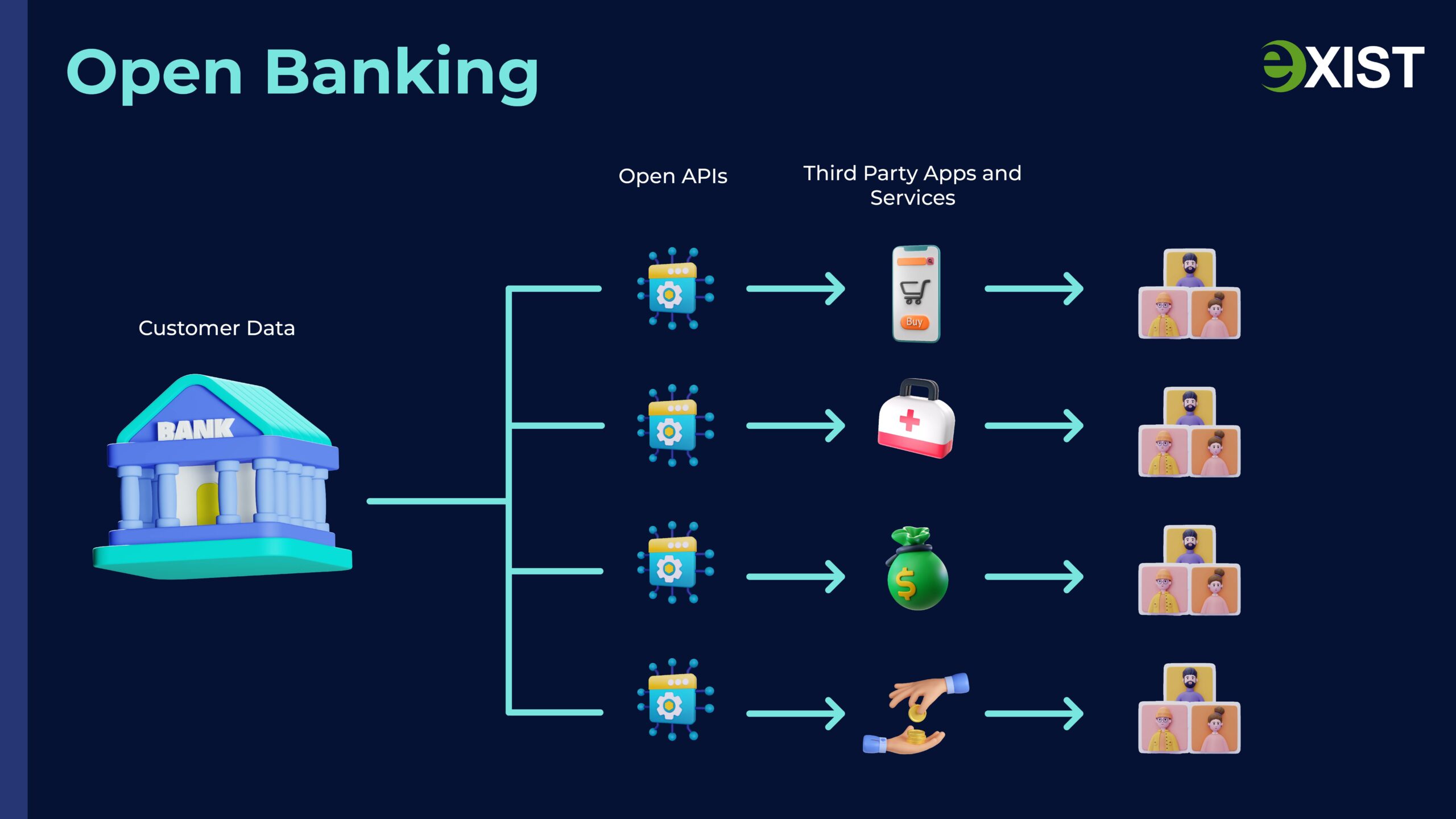

- Investing in digital banking solutions: Digital banking solutions, such as mobile banking apps and online banking portals, can provide customers with a seamless and convenient banking experience. By investing in these solutions, banks can meet their customer’s evolving needs and expectations.

- Prioritizing user experience: Banks should prioritize the user experience in all their interactions with customers. This means ensuring that their website, mobile app, and other digital channels are easy to use and navigate, with clear and concise information.

- Personalizing banking solutions: Banks can use data analytics to understand their customers’ needs and preferences. This can help them to provide personalized banking solutions, such as customized investment portfolios and loan products.

- Measuring customer satisfaction: Banks should regularly measure customer satisfaction to identify areas for improvement and ensure that they are meeting their customers’ needs.

In today’s competitive banking industry, adopting a customer-centric approach is essential for driving better revenue and building strong customer relationships. By investing in digital banking solutions, prioritizing user experience, personalizing banking solutions, training staff, and measuring customer satisfaction, banks can ensure that they are meeting their customer’s needs and providing a seamless and personalized banking experience.

At Exist Software Labs, Inc., we understand the importance of customer-centricity in banking. We are committed to providing innovative and personalized digital banking solutions that prioritize customer experience and satisfaction. Contact us today to learn more about how we can help your bank drive better revenue and build strong customer relationships.

Contact Us Today to Learn More about Digital Banking!

Start your Digital Banking journey that is secure, scalable, connected, cloud-ready & flexible.