Exist Anahaw POS Version 3

Six years have passed since we developed Exist Anahaw Retail Platform and pushed it into the market. The goal was to build a system that will enable retail businesses in understanding their customers, have an efficient operation, and be steadfast in a fast-changing retail environment. Today, we are proud that Exist Anahaw achieved this and is continuously improving.

This 2021, we released Exist Anahaw POS Version 3. This newly updated system will continually push the platform’s boundaries by adapting modern technologies to further enhance technical capabilities by making it more customizable, providing more hardware support, and improving overall performance. By using Anahaw Version 3, both clients and those who are looking for a new platform will be able to use and check the right technology to improve their overall business operations.

Designed for medium to large retail enterprises, Anahaw is a fully integrated retail solution that provides today’s retailers with end-to-end functionality. But the journey is not done in innovating and giving a better experience to our clients.

Exist developed Anahaw Version 3 that serves as the upgraded and future-ready POS system.

Introducing Anahaw POS Version 3:

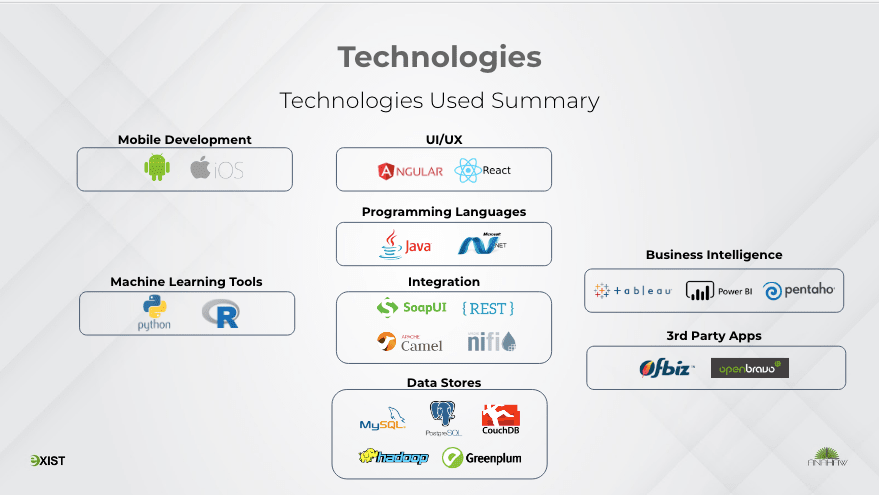

The old version was a browser-based software which is limiting and dependent. Our team decided to build Anahaw Version 3 using Java and upgraded it as a robust software that performs better memory handling and processing, can easily connect even with new POS peripherals, and can flexibly integrate APIs.

We have also upgraded its local document database enhancing its performance. Now we also have local reports that you can use to check transactions made daily, from your sales, items sold and tenders accepted. This also includes BIR-required reports.

POS software is now easier for everyone to audit and inspect. It has been updated with the latest BIR Requirements, and we can easily comply with the latest memorandums. By the way, we’ll have an “Athlete’s Discount” available soon.

Anahaw POS Version 3 is now more intuitive as its interface has a cleaner and lighter feel so the person who operates it can easily navigate the POS application. POS functions are easily accessed with button selections. Users can perform transactions like scanning items, applying discounts, and tendering payments making it faster for the cashier to do the transaction. Buttons can easily be activated with the use of mnemonics or alt-key combinations. No more labeling of keys, no more memorizing of shortcuts.

We have added a customer service feature to facilitate returns and replacements properly. This feature clearly defines the separation of POS transactions from your Customer Service transactions. As for your IT or DevOps, they can use Anahaw POS Version 3’s Command Center, to have updates or patches installed right from your headquarters, view the terminal’s current build number, and check the logs on transfers made between stores to headquarters and vice versa.

With the introduction of Exist Anahaw POS Version 3, our team is delighted to introduce this newly upgraded platform to all of our clients as we start our transition to fully deploying the new version this year. Exist will continue to support Anahaw Version 1 until this year and will then be tagged as a Legacy System by 2022 thus ending its lifecycle.

We are excited to see Exist Anahaw POS Version 3 rolled out to our clients and experience the difference!